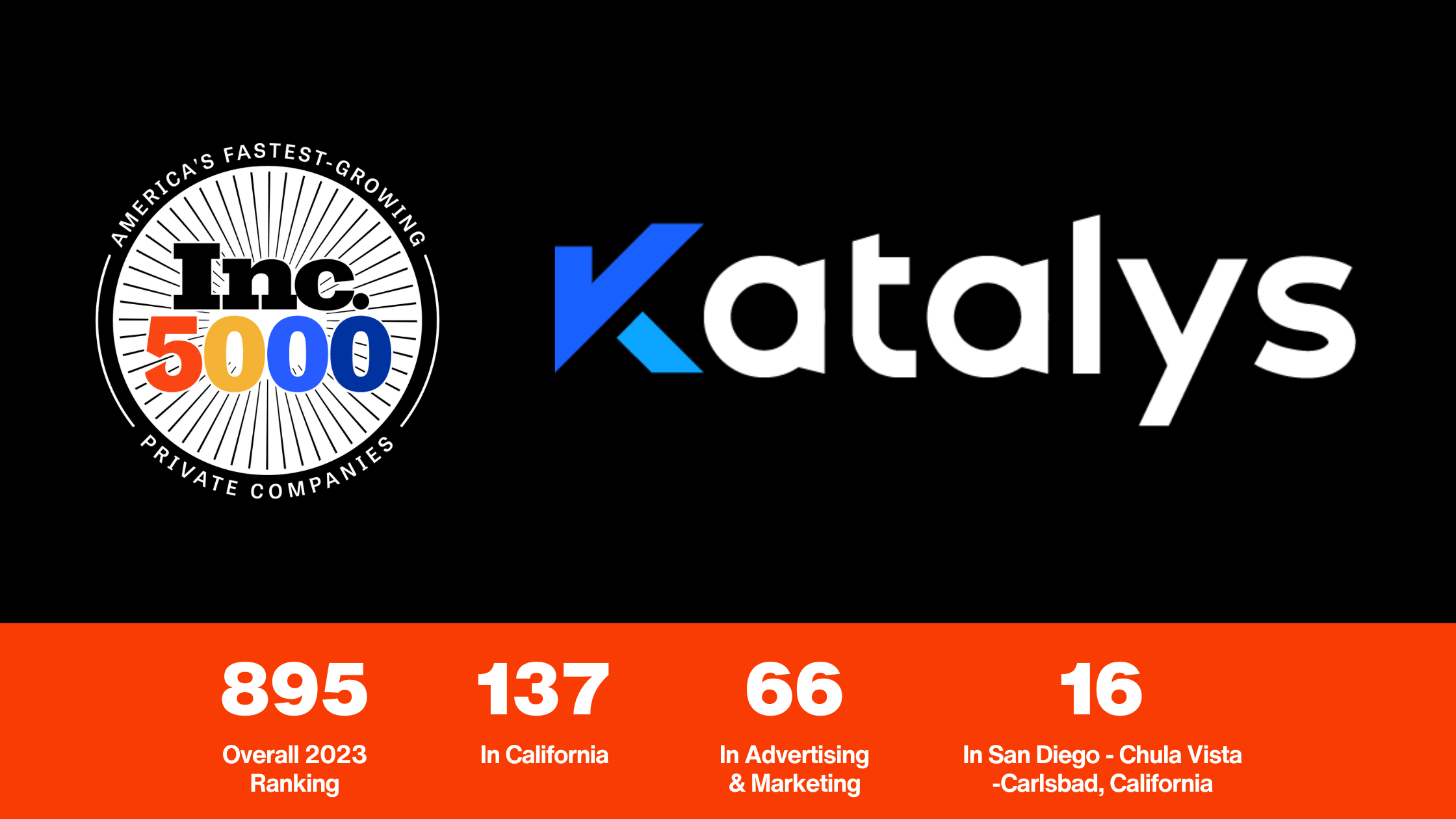

ABOUT US

Accelerating Innovation in Commerce Media.

Katalys lives at the intersection of performance marketing, technology, content, and commerce. While our goal is to find the omni-win for all our stakeholders, we’re constantly looking for new ways to add value, especially through tech-enabled products and services.

Work With Usour partners

OUR VISION

Empowered, Omniwin Partnerships.

Our vision is to improve how commerce is transacted on the internet while empowering the world’s greatest brands and publishers to create Omniwin partnerships.

Our Values.

Positive Change

Trailblazing

Honor

Conscious Growth

Empowerment

Insight

OUR CULTURE

What Success Means to Us.

Our company has built a world-class culture that is inclusive, rewarding, and driven by the collectivist ideal that when one team member succeeds, we all succeed. We are fully dedicated to developing, nurturing, and supporting our employees to reach their full potential.

Leadership

work with us

Become a Katalys.

If you want to become a key member in helping us drive the future of commerce media, learn about our open positions.

Learn More